Self Managed Super Fund Services

What is a superannuation fund?

Things that will empty your super tank:

- Bad investments

- High fees

- Tax

- Spending (in retirement)

- Cash or term deposits with any bank

- Corporate bonds

- Blue chip shares

- Property

- Collectables

- Gold

- Commodities or;

- Any other investments you want as long as this is allowed by the laws.

What is a self managed super fund?

Our SMSF Administration Service

Our self managed super fund administration is designed to look after you. We do not charge you exorbitant and percentage based fees using the balance of your account. Our service gives you a real-time overview of your superannuation and/or pension account(s). We help you set up your SMSF at very competitive prices and provide you a wide range of flexibility with respect to where you can invest without charging you exorbitant fees. We do this whilst providing quality customer service.

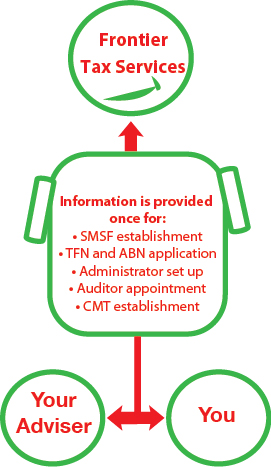

You can also ask us to act as a conduit between you and your other professional advisers, ensuring that everyone is on the same page with your future at no additional cost to you. Imagine for example that you want to buy property in a SMSF, by contacting us, we can help you to:

- Set up an SMSF

- Organise the instalment warrant “borrowing” arrangement

- Liaise with our allied professionals or your nominated ones to source a loan and a premium property for you and;

- Administer your SMSF for you.

How it works

Why Frontier Tax Services?

If you want to buy a commercial or direct property in your superannuation fund, we make your experience smooth and easy by;

- Setting up your self managed super fund and associated structures

- Helping you source a suitable loan through our allied professionals and;

- Helping you locate and purchase a suitable property.

Apply now for the Borrowing SMSF

Apply now for the No Borrowing SMSF

Apply now for the SMSF Administration Package.

Taxation of super

- The name you have nominated for your fund (eg. The Smith Family Superannuation Fund)

- The names, dates of birth, address details and tax file numbers of each member

- Decide if you are going to use individual trustees or corporate trustee

- if you decide on a corporate trustee, the name you would like to use when we register this company for (for example the Smith Family Trustee Services Pty Ltd)

- Identifications: drivers license, Medicare cards and passports for each member. You will not need all of these, just enough for us to establish your identity.